To read about the Stolper-Samuelson theorem, click here.

Proof of the Stolper-Samuelson theorem

The Stolper-Samuelson theorem says that in free trade, given two goods, an increase in the price of one good will result in an increase in the return to that good, and a fall in the return to the other good.

There are two proofs to the Stolper-Samuelson theorem provided in this paper. I will be working through the first one.

Part 1: Introduction

Assume two homogenous goods, A and B, and two factors of production, labor and capital (denoted by L and K respectively). Both goods use a mix of labor and capital, but good A is capital-intensive, while good B is labor-intensive.

Part 2: The dynamics between capital and labor in two industries

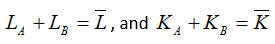

1. Assume that the amount of labor and capital in the economy are fixed. This will be denoted by L bar and K bar.

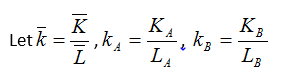

The total labor used in the economy is the sum of the labor used in industry A and the labor used in industry B. The total capital used in the economy is the sum of the capital used in A and B as well, i.e.:

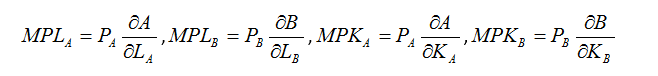

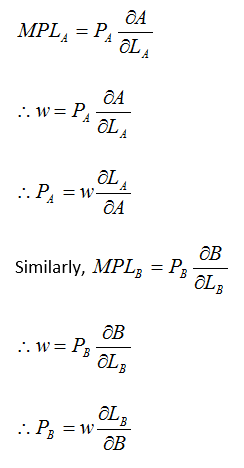

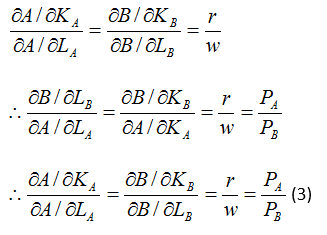

Part 3: Prices, marginal product, wages, and rent

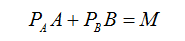

1. Let all the production in the economy be M. Let the price of good A be PA and the price of good B be PB.

Thus:

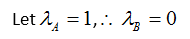

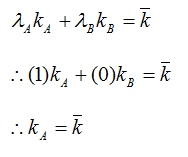

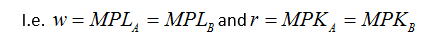

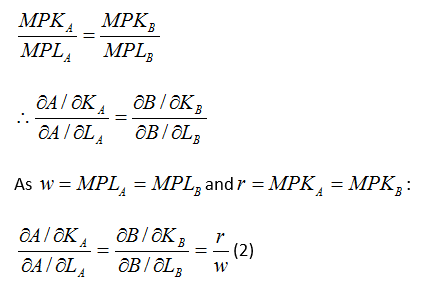

When free trade takes place, “trade would reduce the relative price of the import-competing good”, according to the paper. In other words, PB would decrease. As PB decreases, labor and capital moves towards good A, as it is more profitable.

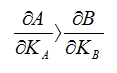

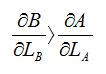

When the price ratio increases, the marginal product of capital in industry A will increase more than the marginal product of capital in industry B, as industry A is capital-intensive, i.e.

RSS Feed

RSS Feed