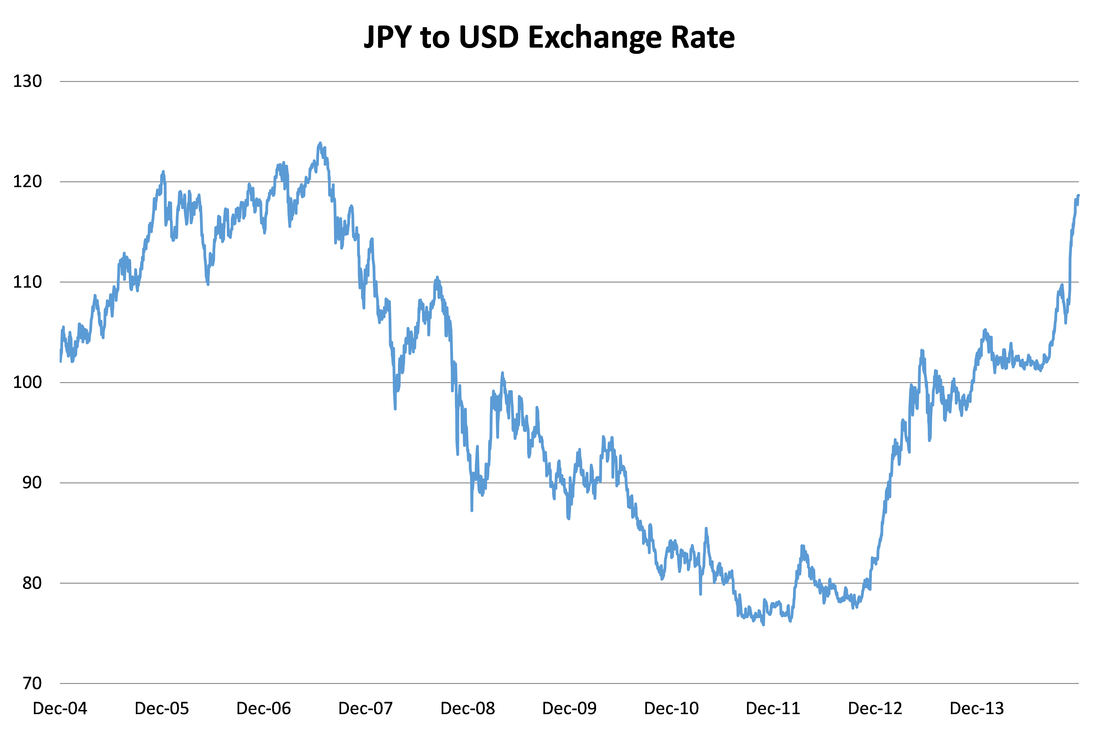

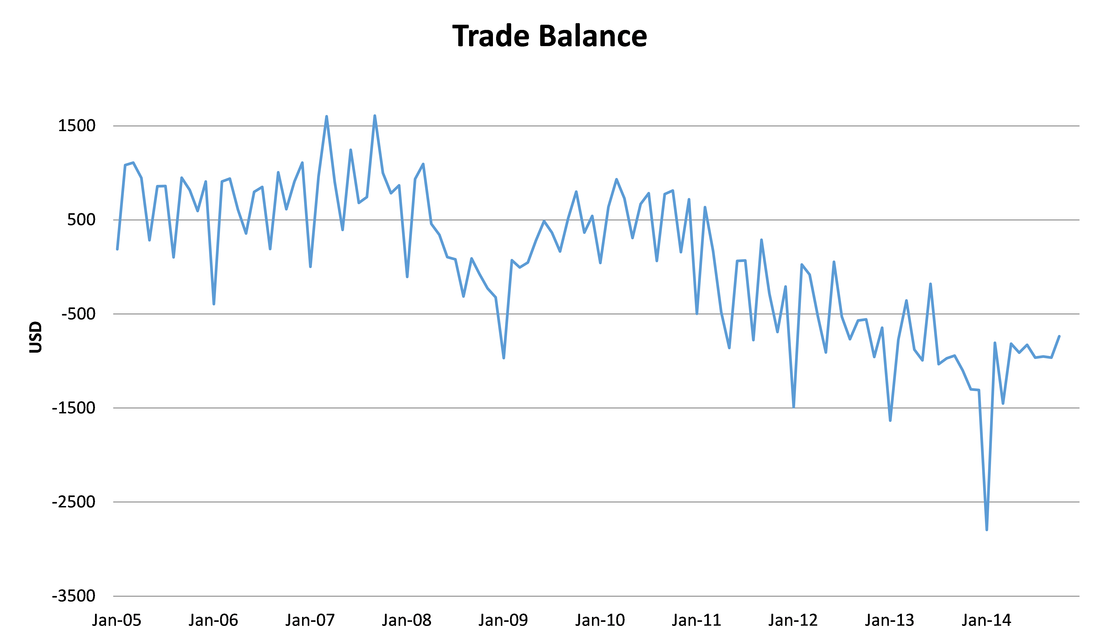

Firstly, this article claims that a depreciation in the JPY should increase exports. Here is a chart of the JPY to USD chart from The Bloomberg.

Why could this be? Many people claim that it has to do with the structural rigidities of Japan (i.e. Japan is no longer producing what people want to buy).

RSS Feed

RSS Feed