Click here to read the original article

While a popular opinion is that taxing the rich during times of economic trouble, this article encourages governments to think twice before doing so, pointing out unintended land negative consequences. This article answers three questions:

1. What share of tax do the rich actually pay?

2. What has happened to the tax burden over the recent decades?

3. What does the evidence suggest about how the rich respond to changes in taxation?

The rich pay a substantial amount of taxes nowadays (rich Americans pay the most of OECD countries, at 45%). However, the general trend is that tax burdens have eased up on the rich; many countries have shifted from an extremely progressive tax scheme to a less progressive one-more proportional than anything.

Taxing the rich can be hazardous to an economy-often it is the rich that are most mobile, i.e. an increase in taxes means that the rich leave the country.

Overall, the article suggest that instead of simply increasing tax rates, closing taxation loopholes and broadening the tax base are more efficient ways to bring in income for the government.

Theory:

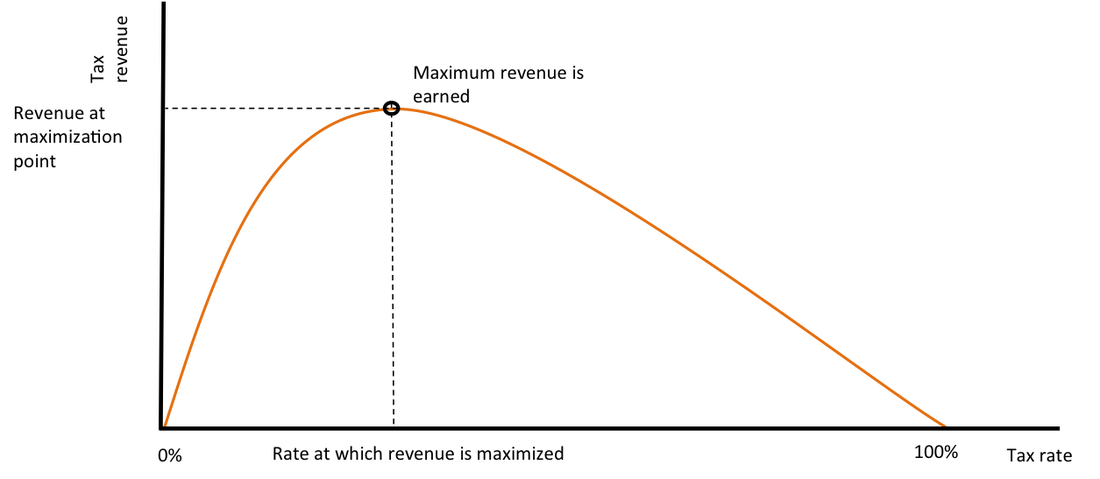

The phrase in the article “beneficial impact of tax cuts” can be very confusing. How is it that a government could possibly earn more tax revenue by cutting tax rates? The Laffer curve best explains this phenomenon. This is the Laffer curve:

Notice how the highest tax revenue does not exactly mean a 50% tax; it could be anywhere, depending on the economy. It can also be multi-modal; it does not have to be restrained to one peak.

RSS Feed

RSS Feed