Click here to read the original article.

Discussion:

This article discusses the history of prevalent economic thought and its effects on politics. Throughout history, politicians have adopted only those economic policies that allow them to stay in power. In this way, a country’s economic issues can be viewed through the “prism of the political structure.”

19th Century:

Political scenario: Wealthy creditors with no real interest in the government were concerned with “maintaining the real value of their money”, as can be seen by the use of the gold standard (explained in Key Terms) and their one allowance of government intervention, through the use of the central bank, to ensure the success of the financial system.

Economic climate: Classical theory dominated economics. Classical theory concerned itself with the self-correcting nature of an economy (explained in Context), and thus reasoned that the government had little place in the free market.

1914 – 1929:

Political scenario: World War I (1914-1918) resulted in the sudden need for ammunition and manpower. The brief respite during the Roaring Twenties was overshadowed by the Great Depression, which began in 1929.

Economic climate: Government intervention, high inflation and debt during World War I destroyed classical theory. Any attempts to rebuild classical theory during the twenties were outweighed by the Great Depression: there was great reluctance by mass democracies to put the strain of the gold standard on the already suffering working class.

1930s and 40s:

Political scenario: In the aftermath of the Great Depression, economies did not return to full employment. This was a great cause for concern among politicians, and the worry was carried into World War II.

Economic climate: Popular economist J.M. Keynes focused on government spending to boost demand, and thus, lower unemployment, through the use of fiscal policy (explained under Key Terms). This theory gained traction during World War II, where government intervention increased greatly and unemployment was wrestled down to a manageable level. Welfare states (explained in Key Terms) seemed like a small concession compared to the threat of communism (explained in Context).

1960s and 70s:

Political scenario: The rapid rise of inflation led politicians to believe that the government focus on unemployment was wrong. Middle-class voters, angry at high taxes, were quick to support an economic reform. Reagan and Thatcher adopted new policies quickly, with Europe following later, having been shaken by the scare of Eurosclerosis (explained under Key Terms).

Economic climate: The previously successful Phillips curve (explained under Context) was falling apart. Milton Friedman and his followers thus argued that governments should shift their focus away from controlling unemployment and towards managing inflation through controlling the money supply. Supply-side economics (explained in Key Terms) became popular quickly, as did monetary policy, which led to an active central bank.

1980s and 90s:

Political scenario: The fall of inflation resulted in a reputation boost for central bankers, despite the fact that inflation may have decreased due to China’s entry into the global economy (explained under Context). Reagan's and Thatcher’s reforms were well underway, which led to a rise in the debt-to-GDP ratio.

Economic climate: Reagan's and Thatcher’s reforms meant the recognition of the financial sector as a key player in any economy.

1987:

Political scenario: The riskiness of the system that ensued from the increasing debt-to-GDP ratio encourage central banks to cut interest rates during any period of uncertainty, as was seen on Black Monday.

Economic climate: Economic actors interpreted central banks’ nervous response to a wobbly economy as their “[underwriting of] asset prices”. Buying assets with borrowed money seemed to be the quick and easy way to make fortunes.

1990s:

Political scenario: The end of fixed exchange rates, and along with it, capital controls (explained in Context) made global finance very powerful, as money could easily enter and exit economies and sectors. At the same time, the wealth of the financial sector allowed its key players to fund and win favour of the political elite.

Economic climate: The loss of control over capital flows turned government focus towards dissuading capital flight, while the wealth of the financial sector meant that politics supported economic policy that favoured financial markets.

1980s to 2007:

Political scenario: The threat of communism fell along with the Soviet Union. Center-right politicians who had acquiesced to government regulation during the Great Depression gained political power, while center-left politicians supported more right-wing policies. At the same time, trade-union power fell, partially due to globalization, and partially due to the “relative decline in manufacturing”. Organizing protests became harder when many of its remaining members were dispersed across different jobs in different economies.

Economic climate: Right-wing economic policies such as the freedom for free markets to function with minimal intervention were established. The decline in trade-union power and blue-collar worker votes resulted in the larger economic actors having a greater say in shaping economic policy. It is no surprise that today we see the central banks and other large institutions as the most powerful actors in our economies.

During this time, mainstream economic theory became more micro-based as well as mathematical, despite the rise of behavioural economics.

2008 on:

The aftermath of the Great Financial Crisis has taught us that debt and the financial sector should be more central to macroeconomics and macroeconomic policy. Popular policy focus now is on attacking and trying to prevent the effects of globalization, such as the movement of jobs away from developed economies to countries that provide cheap labor. The problem is that globalization has already happened, and its effects are already underway. What will determine the success of globalization is how the Chinese economy will deal with its financial system and whether the Federal Reserve will withdraw its monetary stimulus effectively.

Just as politicians have always reacted to the economic climate, we may find that our future economic state may be a shift away from globalization and towards nationalism.

Key terms:

1. Gold standard: A system in which the value of currency is fixed in terms of gold, and could be traded in for gold.

2. Fiscal policy: the process of government spending to stimulate demand (fiscal expansion) or government saving to decrease debt (austerity).

3. Welfare state: Where the state plays a pivotal role in protecting and promoting the economy and its citizens.

4. Eurosclerosis: A term coined in the 70s by Herbert Giersch to describe the state of stagnation in Europe that may have resulted from over-regulation by the government.

5. Supply-side economics: also known as “trickle-down economics” and “Reaganomics” – the latter due to Reagan’s active promotion of supply-side economics – argues that production is the most important determinant of economic growth. For this reason, investors and businessmen should face less barriers to production and investment through lower taxes.

Context:

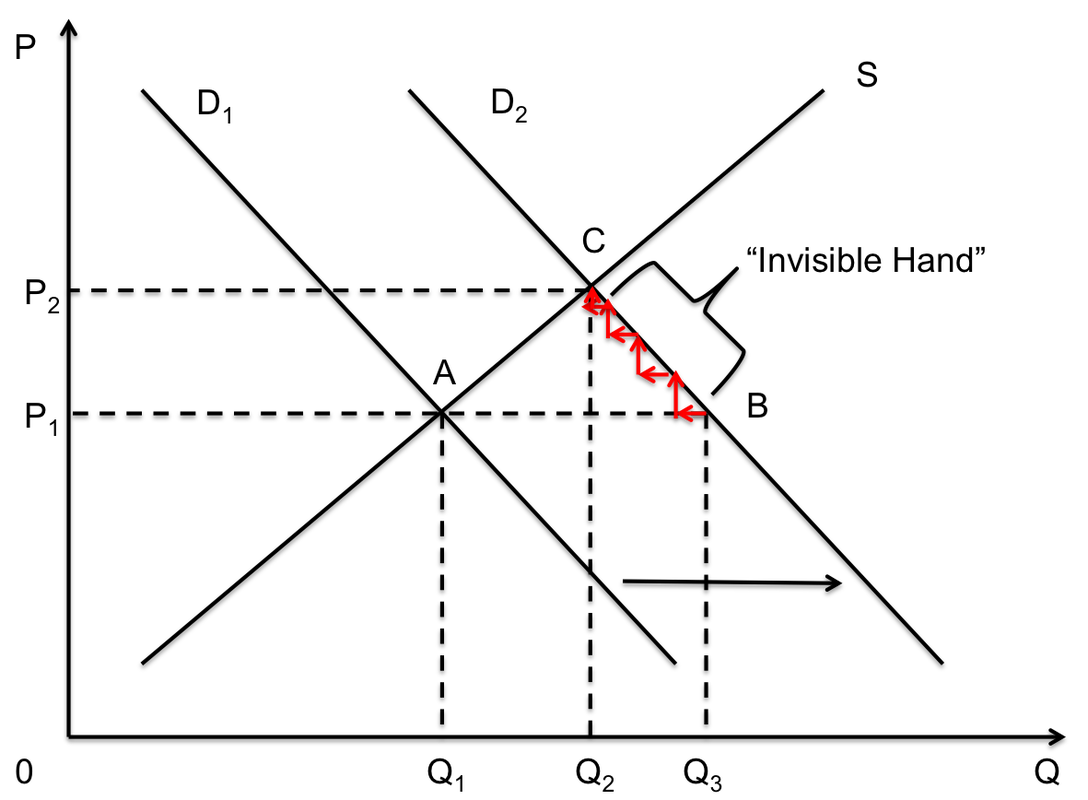

1. Classical theory: The self-correcting nature of markets was first alluded to by the father of Classical theory, Adam Smith. The idea is that prices adjust themselves and equilibrium is regained in the economy.

Now, demand for X increases to D2. At the original price P1, more of X is demanded, resulting in quantity demanded Q3. This is point B. Seeing the increase in demand, suppliers increase the price of X to increase their profits. Now, fewer people can afford the good, but enough people still want more of the good that suppliers feel like they can increase the price. Still fewer people can afford the good, but suppliers can still increase the price. This process, indicated by the red arrows, continues until the economy adjusts to a new equilibrium C, where all the demand is met by supply. Classical economists refer to this as the work of the invisible hand, guiding the economy from one equilibrium to another.

While the theory of the invisible hand is often attributed to Adam Smith, Smith used it as a term to

discuss international trade, and did not mean it to be the process described above. Still, Smith, along with other classical economists like David Ricardo and John Stuart Mill, believed the economy to be self-correcting.

2. Why would the presence of a welfare state result be a small price to pay in the face of the threat of communism? During the Great Depression, it is the democratic countries that suffered, while communist countries seemed to be fairing better. To ensure that communism does not dominate democratic countries, the government had to ameliorate the economic situation by being heavily involved in the economy.

3. To learn more about the Phillips curve and its failure in the U.S. economy, read my article here.

4. Why did China’s entry into the global economy decrease inflation? Not only were cheap goods and services provided by China, but so was cheap labor. For this reason, costs of goods, services and labor fell around the world, resulting in decreased inflation.

5. Why would the end of the fixed exchange rate system lead to the end of capital controls? Under a fixed exchange rate regime, high levels of reserves are needed to keep the exchange rate from fluctuating. For example, Hong Kong needs high levels of reserves for its currency to remain pegged to the U.S. dollar. If, for some reason, Hong Kong becomes less appealing to investors, the demand for the Hong Kong dollar will decrease, and the reserves will deplete. Capital controls are needed to make sure sudden capital influx or capital flight does not deplete the reserves, and thus, the exchange rate.

RSS Feed

RSS Feed