Click here to read the original article.

This article by Greg Ip details a debate between former Federal Reserve Chairman Ben Bernanke and former Treasury Secretary Larry Summers about why interest rates in America are so low. While Summers argues that it is due to secular stagnation, Bernanke disagrees, citing “cyclical and special factors” as the reason for low interest rates.

Secular stagnation includes low growth, low inflation and low interest rates and lasts a substantial amount of time. As Ip points out, it is the real interest rate (nominal interest rate – inflation) that is important. It is the real interest rate that balances savings and investments. More about this will be explained under ‘Context’.

Summers states that the “real rate needed to balance desired saving and investment may actually be negative”, a key factor of secular stagnation.

Bernanke disagrees that the real rate may be negative and details a scenario to illustrate his point. The rough idea is that if the real interest rate was always negative, then all investments would be profitable. Due to an increase in demand for investments, the real interest rates would increase.

Greg Ip further illustrates this point by outlining a scenario with stock dividends, where, if the real interest rate were 0%, the value of the stock would theoretically be infinity, and if the real interest were negative, the equation becomes nonsensical. This will also be explained under ‘Context’.

Summers retaliates by showing that, according to Summers, “rates in America have been negative at least 30% of the time”. His reasoning behind this is that “negative real interest rates are a phenomenon that we observe in practice if not always in theory”.

How is that possible? There are a few reasons for this.

1) While government bonds, or risk-free bonds, are negative, private borrowers would often pay a positive due to the higher risk involved in giving private borrowers loans. Further, investors may demand an “even higher hurdle, especially if they expect the project’s profits to grow quite slowly in a stagnant economy”.

2) Bernanke agrees that real rates can be negative temporarily, not permanently. (Here, Ip points out that Summers never argued that the interest rate was permanently low, it could just be for a 10-15 year time period).

Even if the real rate was not negative, secular stagnation could still be a culprit in low interest rates as secular stagnation does not need rates to be negative, just low.

Next, Bernanke faults Summers for downplaying the international element of the argument. If it were true that there was a lack of profitable investments in the US, the savings would go abroad, increasing interest rates in the US. Bernanke believes that the weak recovery of 2002-06 was due to a global savings glut, as opposed to Summers’s belief that the weak recovery was due to secular stagnation. China and other countries with large trade surpluses “saved more than they invested and exported the rest to the US”. Therefore, the lack of US growth, according to Bernanke, was because imports were displacing domestic production. Since then, China’s trade surplus has decreased while Europe’s has grown, but Bernanke thinks this is a “cyclical, temporary problem”.

Paul Krugman questions Bernanke’s theory that open capital markets would not depress real interest rates by citing Japan as an example. Bernanke however argues that while interest rates were extremely low, inflation was lower, causing real interest rates to be slightly higher than that of the US.

Greg Ip then cites a few reasons why he believes interest rates are so low:

1) Worldwide monetary policy. When QE ended in the US, which had brought real rates worldwide down, ECB’s QE began, keeping the real rates down.

2) Supply side factors – slower growing labour and productivity.

a. Slowing labor can be classified as slower population growth, which depresses the supply of workers and investment, as a smaller workforce need less machinery and other equipment. It also depresses demand, as retirees consume less and aging workers save more for retirement.

b. Productivity has also slowed down worldwide, partly due to the residue of the financial crisis on capital spending, which will eventually fade. However, it also reflects a lack of innovation. And firms may invest less because they see “fewer payoffs to new technology”. Robert Gordon, a famous economist in the productivity field, also cites education attainment no longer increasing as why growth is slowing down.

Key terms:

1. Financial bubbles: where there is an unsustainable increase in asset prices such as stocks, houses, property and even land.

2. Risk-free interest rate: The interest rate acceptable to a lender when he believes that the borrower will not default on the loan. In practice, this refers to the interest rate on US treasuries, which are considered the safest investment.

3. Hurdle: The minimum expected rate of return from a project, below which the investors will not go ahead with it.

Context:

1. Economists care about real interest rates rather than nominal interest rates. As inflation erodes the purchasing power of the interest earned by the lender, he will make lending decisions based on interest rate after deducting the inflation; in other words, the real interest rate.

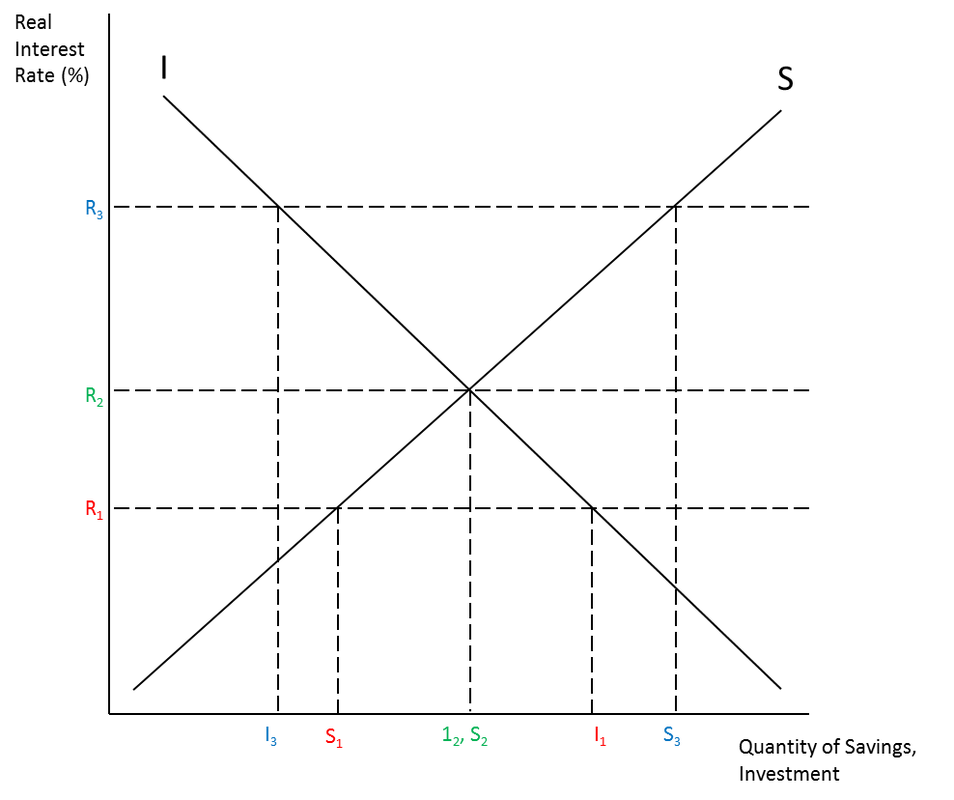

2. An important idea to understand from this article is the relationship between real interest rates, savings and investments. As stated in the article, investments can be considered demand for savings, while savings can be considered supply of savings. The diagram below illustrates the relationship.

3. Nominal interest rates cannot be negative. Given the equation that real = nominal – inflation, real can still be negative, if inflation > normal.

4. Gary Ip’s discussion of stock dividends: A stock is worth the sum of its future dividends, discounted at an appropriate interest rate to bring them to today's present value. In other words:

Stock value = D/(1+i) + D/(1+i)^2 + D/(1+i)^3 + D/(1+i)^4 + D/(1+i)^5 ...

(assuming that the stock pays a fixed divided of D every year and i is the interest rate).

As you can see, as the value of i falls, the stock value increases; if the value of i reaches zero, the stock value is infinity; if the value of i goes below -1, then the equation turns nonsensical.

5. Larry Summers states that “negative real rates are a phenomenon that we observe in practice if not always in theory”. This is an allusion to Bernanke’s earlier statement that quantitative easing works in practice if not always in theory. More about that can be read here.

6. There is a discussion about the 2002-2006 weak recovery. The context of this is that, during that time, China exported high volumes of goods to the US, and used the resulting surplus to invest back in America, which led to low real interest rates, and displaced domestic production in America.

7. One important thing to consider is why there is persistent low growth in America, as that is reason for QE and low interest rates in the first place. Some reasons for low growth to persist are:

a. The benefits of technology adoption are finished. Tyler Cowen, a professor at George-Mason university, is famous for discussing this concept in his book “The Great Stagnation”, the gist of which is that the low hanging fruits have already been plucked.

b. Retirement of baby boomers.

c. Long left over effects of the Great Financial Crisis (GFC).

d. Ageing population.

RSS Feed

RSS Feed